If you walk into a grocery store and see a gallon of milk for $15, you don’t buy it. It doesn’t matter if you need milk. It doesn’t matter if it’s the best milk in the world. You don’t buy it because the price is wrong.

Yet, every day, thousands of sports bettors pay $15 for a gallon of milk.

They bet on huge favorites or inflated player props simply because they think the bet “will win,” without ever calculating what that bet actually costs them.

To stop gambling and start investing, you need to stop asking “Who will win?” and start asking “What is the Implied Probability?”

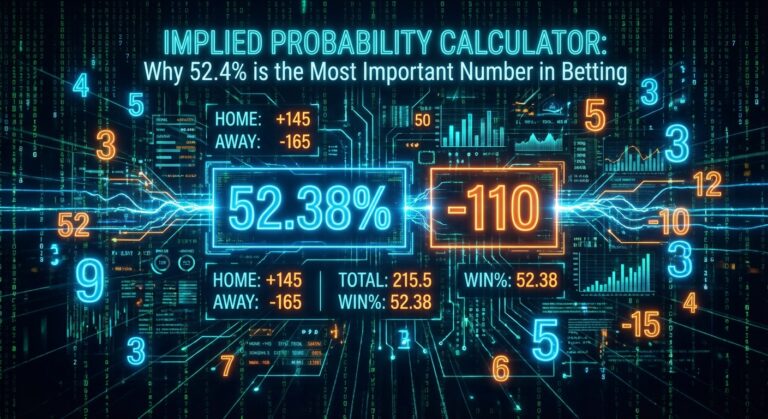

Here is why 52.38% is the most important number in your betting career.

The Math Behind “-110”

When you open your sportsbook app, almost every standard spread or total is listed at -110.

This is the “vig” (or juice). It means you have to risk

110 to win 100Most beginners think a bet is a 50/50 coin flip. If you pick the spread correctly, you win. If you don’t, you lose.

But because of the tax (the -110), winning 50% of your bets actually guarantees you will go broke.

To calculate the Implied Probability (the percentage of time you must win to break even), use this formula:

Risk / (Risk + Reward) = Implied Probability

For a standard -110 bet:

110 / (110 + 100) = 0.5238

52.38%.

This is your “Break-Even Rate.” If your betting model hits at 51%, you are losing money long-term. If you hit at 53%, you are printing money. The margin for error is razor-thin.

How to Spot “Value” (The Edge)

This is where tools like Stats Bench separate the pros from the Joes.

Let’s say you want to bet on Jalen Brunson Over 28.5 Points.

The sportsbook has the line at -110.

This means the market implies Brunson has a 52.4% chance of hitting that Over.

Now, you look at your Model or Cheat Sheet.

Based on the matchup, the pace of play, and the defense, your model projects Brunson hits this number 56% of the time.

- Implied Probability (Cost): 52.4%

- Actual Probability (Projection): 56.0%

- The Edge: +3.6%

This is a bet.

Even if Brunson misses tonight, it is a mathematically correct bet. You bought the milk for $2 when it was worth $4. If you make that trade 1,000 times, you will be rich.

The Trap of “Buying Wins”

Now, let’s look at the reverse.

The Chiefs are playing the Raiders. You are convinced the Chiefs will win. The Moneyline is -250.

- The Math: 250 / (250 + 100) = 71.4%

The sportsbook is saying the Chiefs must win this game more than 71% of the time for this bet to be fair.

If your model thinks the Chiefs win 65% of the time, you must pass.

Yes, the Chiefs are likely to win (65% is a favorite). But the price (-250) is too expensive. You are paying for a 71% certainty but only getting a 65% reality.

Conclusion: Be the House

Sportsbooks don’t beat you because they know the future. They beat you because they charge a 52.4% tax and know most bettors only pick winners at a 50% clip.

Stop looking for “Locks.” There is no such thing.

Start looking for Price Discrepancies.

If the Implied Probability is lower than your True Probability, fire the bet. Over the long run, math always wins.

Frequently Asked Questions

The implied probability of -110 odds is 52.38%. This is calculated by dividing the risk amount (110) by the total payout (210). This means a bettor must win at least 52.4% of their wagers at -110 odds just to break even over the long term.

For positive odds (underdogs), the formula is: 100 / (Odds + 100).

For example, if a team is +200, the math is: 100 / (200 + 100) = 0.333, or 33.3%. This means the underdog needs to win only 33% of the time for the bet to be profitable.

Implied probability tells you the “Break-Even Rate” of a bet. By comparing the Book’s implied probability against your own betting model’s projection, you can find “Positive Expected Value” (+EV). If your model says a team has a 60% chance to win, but the odds imply only 52%, that is a profitable bet.

Yes. The implied probability includes the “vig” or “juice.” If you calculate the implied probability of both sides of a game (e.g., -110 and -110), the total will add up to roughly 104.8%. That extra 4.8% is the sportsbook’s guaranteed profit margin.